Your Future Self Will Hate You: Why Waiting One More Year Costs You Everything

Stop overthinking. Start investing. Here's how.

Stop Learning More About Investing, Start Investing Smarter: The Framework That Changes Everything

If you don't take action today, you will be broke forever.

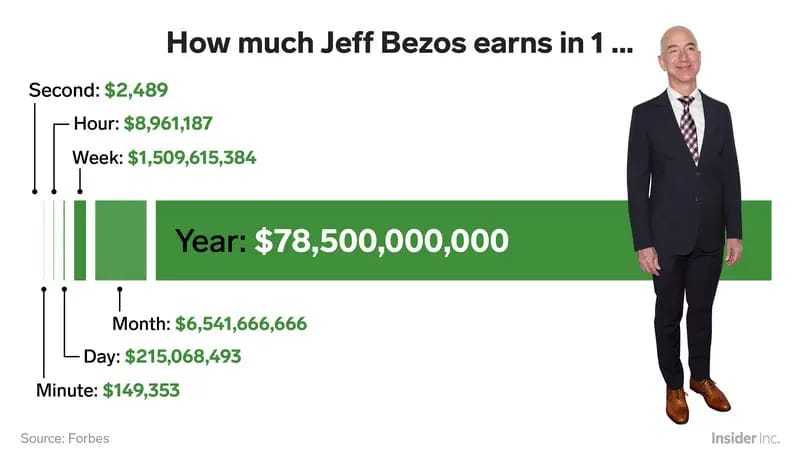

Millionaires and billionaires are building wealth exponentially through investments while you're still reading articles about "how to start investing."

graphic is from 2019. in one day, he made more money than I made in a year.

I thought I was late to the game.

I thought I was late to the party.

But here's the truth: there's no excuse not to start today.

Because if not, you'll be broke forever.

I was afraid of investing because I assumed that becoming good requires years of studying financial statements, reading every Warren Buffett letter, and following markets obsessively. But that's cap!

I stopped treating investing like I needed to become a CFO (Chief Finaical Officer) before putting my money to work. Let me share the framework I subconsciously used when I started investing that saved me thousands of dollars and years of mistakes.

Why This Matters NOW

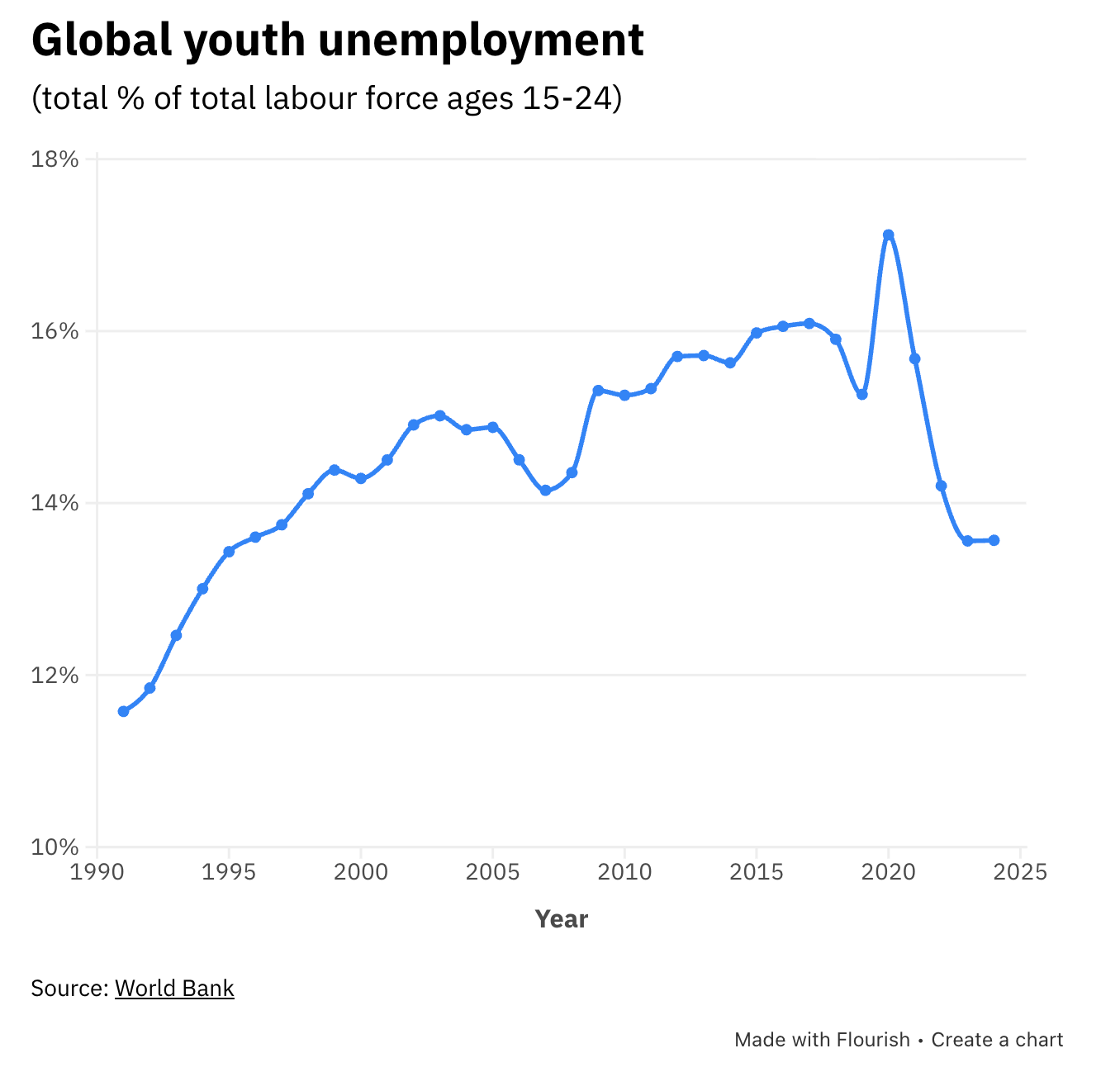

We're heading into a world where AI is displacing jobs, youth employment rates are dropping, and everyday people are becoming entrepreneurs. There's going to be massive capital changing hands in 2026 and beyond (it’s lowkey already happening).

damn. Gen-Z is really going through it 😮💨.

The question is: what will you do with that money?

Here's the brutal math: someone who starts investing properly in 2026 versus someone who waits until 2030 will be miles apart. Not a little ahead - miles. That's the power of compounding and exponential growth. One year makes a difference. Two years makes a big difference. Four years makes a huge difference.

Think of it like a snowball rolling down a hill. At first, it's small. But as it goes inch by inch, foot by foot, mile by mile, that snowball becomes indestructible. Your investment account is that snowball. The more it grows, the bigger it becomes. And before you know it, it's so big that it's impossible for you to go broke.

your pile of cash rolling over the broke people.

But the window is closing.

Most of my audience is in their early to mid-20s. As you get older 30s, then 40s your window shrinks. Think about average life expectancy: somewhere around 70 years if you're lucky and healthy. If you start investing at 40, you've got maybe 30 years. Really 20, because you want to enjoy the last 10.

But if you start today in your 20s? You get 50 years. Maybe 40 years of active investing. That extra time makes a massive difference.

The “BUILD” Framework for Investing

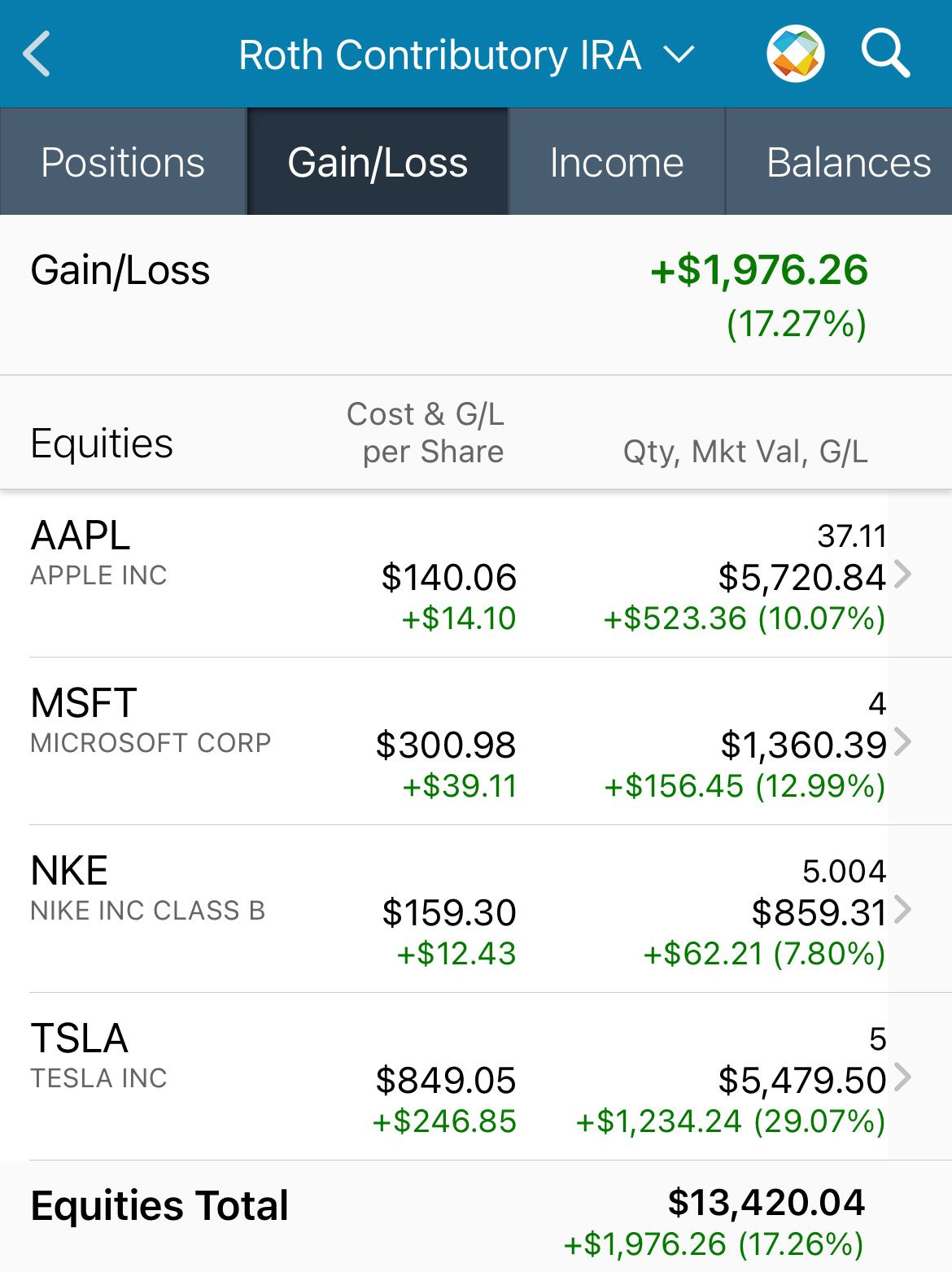

When I was 18, I started investing with a simple automation to my Roth IRA. I chose the Roth because the contribution limit was $6,000 and that felt achievable within a year. I started with $100. Week by week, I added a couple more dollars. Month by month, I added more. Year by year, I earned more income and contributed even more.

real photo from my account around 2020, I think.

Now? It's close to $100K.

But here's what I wish I'd done differently: I should have stayed consistent from day one. At first, I did lump sums of money. Big deposits when I could afford it. But what I want you to do is build a consistent habit of adding contributions over time. Even if it's $10 this week, $100 next week, $1 the week after. Trust me, it makes a huge difference.

Here's the framework that would've helped me avoid years of mistakes:

(B) Break Down the Goal

Do not just ask yourself "how do I become a good investor?" That's not a goal - it's a vague direction.

Break it down into specific, measurable components:

Are you trying to beat the S&P 500?

Generate passive income?

Build a $1M portfolio?

Once you've identified your true target, break it into parts.

The smartest move? Find someone who's already done it. You can get on a call with successful individual investors, financial advisors, or portfolio managers for $100-200 an hour. That conversation compresses what might take you years of expensive mistakes (people lose thousands, even millions on poor investment decisions) into actionable building blocks.

[Side note - If you’re really broke then watch my content, other personal finance creators, or even spend time on Reddit.]

Ask yourself:

What does "good investor" actually mean to me in dollars and timeline?

Who has already achieved this goal that I can learn from?

What are the 5-7 components that make up this goal?

Take action:

Write down your specific investing goal with a number and deadline

Find 3 people who've achieved it (YouTube, LinkedIn, local investors)

Schedule one 30-minute call with someone who's done it

(U) Uncover the Vital 20%

Here's the truth: Investing doesn't have to be complicated. You just need to be consistent.

for my visual learners, this is for you. just show up every day, no matter the amount of energy you have.

This is pure Pareto's Law: identify the 20% that delivers 80% of results.

In investing, there are thousands of stocks, hundreds of strategies, countless indicators to track. You could spend decades trying to master it all.

Or you could learn that for most people, 3 things matter:

Consistent contributions

Low-fee index funds

Time horizon

The difference between someone who retires comfortably and someone who doesn't usually isn't knowledge - it's doing the boring fundamentals consistently.

Here is a cool IG of this Guy that does the basic fitness things every single day consistently, and watch how his body transforms. The same thing applies to money.

For the 20% who want active investing: Focus on understanding 10-15 quality companies deeply rather than tracking 100 superficially. Study businesses in sectors you already understand from your career or stuff that actually interests you.

Let me give you an example: Costco.

hahaha. laugh with me now.

Think about Costco. They're a grocery store, right? But look deeper:

Recession-proof: In any economic condition - market crash, housing crisis, another COVID - people need groceries. They need food to survive. Costco provides that. No matter what happens, they'll always be in business.

Smart pricing model: You buy in bulk, you buy packages. They don't have massive storage or inventory costs because it's already on the shelves, and people buy in bulk. Less inventory, fewer things to worry about.

Membership cult: People love Costco not just for the brand, but to have the card, be a member, and ultimately feel part of a community.

Kirkland brand: Costco sells their own products. They have great distribution AND they sell their own products that bring in massive revenue (if you have time, watch the video below. It's really insightful).

How do I know all this? It's simple: I looked at their financial statements and got a membership myself to see what the hype is about. Long story short - I am really in the streets.

Your edge isn't information because at the end of the day, everyone has access to Google. Your edge is pattern recognition in domains where you have context others don't.

Read that last 2 sentences again. It's really crucial.

Ask yourself:

What 3 fundamentals will drive 80% of my results?

What companies/sectors do I already understand from my life or work?

Which platform will I actually use consistently without getting distracted?

Take action:

Open an account with Fidelity, Vanguard, or Charles Schwab this week

Choose ONE index fund or 3 companies you genuinely understand

Set up automatic transfers - even if it's just $50/month to start

(I) Install the Right Sequence

This is the step everyone skips, and it's why people lose money before they ever make it.

Order matters more than people realize.

Don't start by picking individual stocks. Start with understanding your actual risk tolerance - not what you think it is, but what you discover when your portfolio drops 20% in a month.

Here's the right sequence:

Get comfortable with volatility in index funds first

Understand asset allocation

Then consider individual positions

Most people try to do everything at once and panic-sell at the bottom.

Ask yourself: what's the first domino?

For most people, it's automating contributions to retirement accounts. Not sexy. But it's low effort and it is the foundation everything else builds on.

The biggest lie you've been sold: That investing for 3-5 years is enough. That's not investing—that's gambling. Real investing is a 10, 15, 20 year journey. If you're only thinking 3-5 years out, you're playing the wrong game.

Ask yourself:

Can I stomach watching my portfolio drop 30% without selling?

What's my actual timeline - 3 years or 30 years?

What's the smallest first step I can take this week?

Take action:

Start with index funds for 6 months before individual stocks

Set a rule: "I will not check my portfolio more than once per month"

Automate your first contribution TODAY - even if it's $10

(L) Lock in Accountability

Good intentions to "start investing" aren't enough. Even reading every investing book isn't enough.

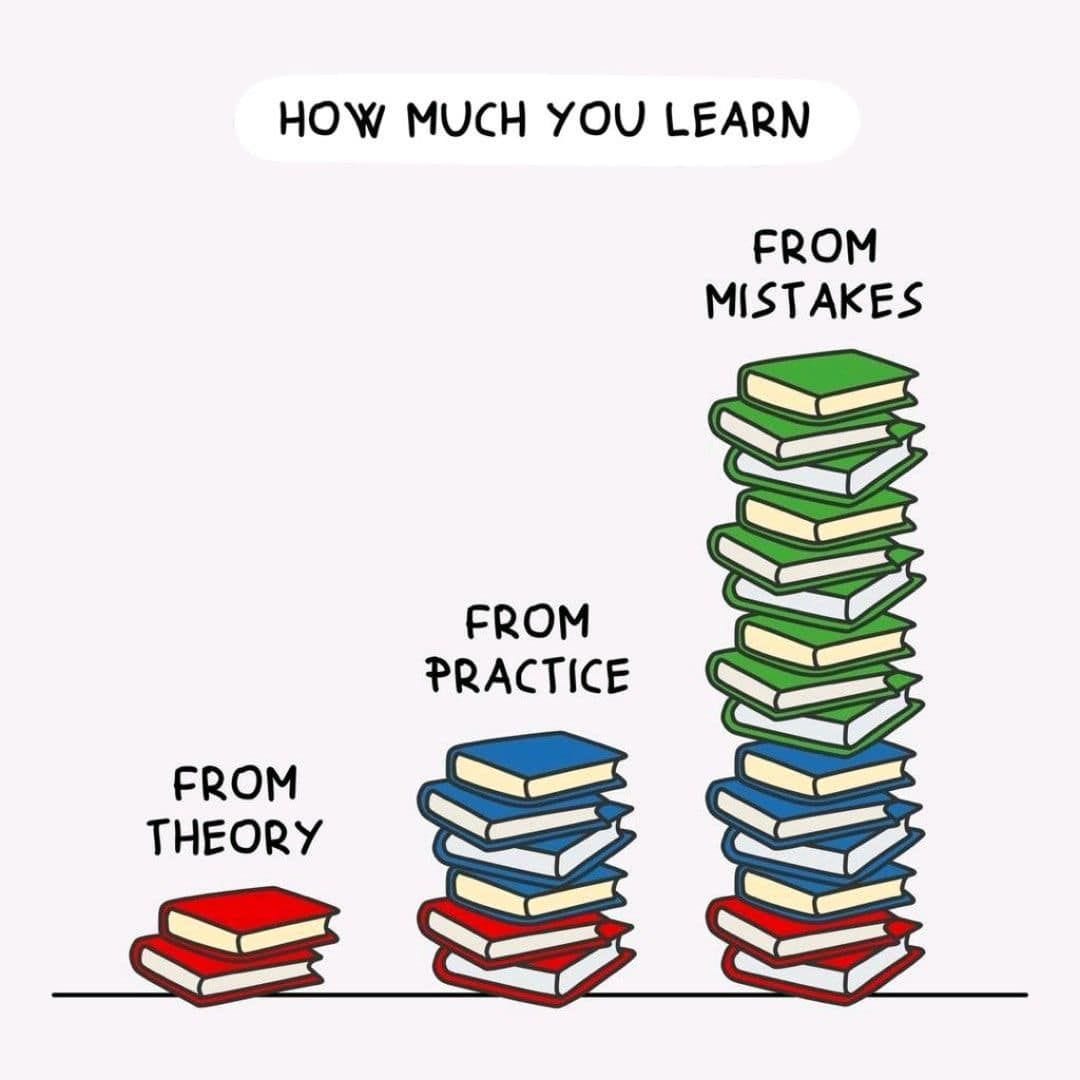

spend all that time planning, but never take action. smfh.

You need consequences that drive behavior.

Here's what works:

Automate transfers the day after payday so the money never hits your checking account

Give a friend $500 to donate to your most hated cause if you don't max your Roth IRA this year (yes, punish yourself)

Set up quarterly portfolio reviews with an accountability partner

The amount doesn't matter - the consequence does!

Here's what I've learned as a finance content creator: People aren't actually afraid of investing. They're afraid of making mistakes.

They're paralyzed by the options. They're confused. They're scared they're going to make an error.

Look - you have to try in this world. If you make a mistake, you can fix it. Open that account, even if it's with the wrong bank or the wrong account type. It's okay. You can always fix it.

fail forward. fail often.

The mistake you CAN'T fix? Not starting at all.

Ask yourself:

What consequence will actually make me follow through?

Who can I report my progress to monthly?

What's my backup plan if I miss a contribution?

Take action:

Text a friend right now: "Hold me accountable to maxing my Roth IRA this year"

Set up automatic transfers for the same day every month

Schedule 4 quarterly check-ins with yourself or a friend

(D) Deploy Consistently

This is what separates those who build wealth from those who just talk about it.

The “BUILD” framework means nothing without execution. This is where your automated systems, your accountability mechanisms, and your sequenced learning plan all come together into regular, repeated action.

Once you start investing, don't stop. I don't care if you only have $10 to invest this week, $100 next week, $1 the week after that. Keep going.

in all seriousness, sometimes even though people give you advice, you have to experience it for yourself to fully understand.

And if you mess up, don't worry. Sometimes you have to touch the stove to see if it's hot or not.

One of my biggest regrets was doing lump sum contributions instead of building the habit of consistent contributions from day one. You want that muscle memory. You want investing to be as automatic as breathing.

Ask yourself:

Have I invested something anything in the last 7 days?

Is my system automatic or am I manually doing it?

What's my plan for the next 12 months of contributions?

Take action:

Make your first contribution within 24 hours of reading this

Never let a month pass without adding something to your account

Increase your contribution by 1% every time you get a raise

The Principles Behind the Framework

The “BUILD” framework is what low-key allowed me to build a strong financial foundation because it operates on deeper truths about investing and wealth building:

Returns aren't linear. Most people quit investing right before the compound curve takes off because markets dropped 15% and they expected steady gains. There will be bear markets. There will be years where you make nothing. If you know they're coming, you hold through them. If you don't, you sell at the bottom and call investing "rigged."

Energy over passion. Don't invest in what sounds exciting. Invest in what you can sustain doing for decades. Can you stomach watching this portfolio during a crash? Can you ignore it for months without checking? Does thinking about this strategy make you want to keep learning, or does it drain you? Optimize for what you can actually maintain, not what sounds impressive at parties.

Short cycles, long compounding. Don't build a 30-year investment thesis. Build 6-12 month learning cycles. Spend three months understanding REITs. Next quarter, dive into dividend growth investing. Test small positions for 2-4 weeks before committing serious capital. This isn't short-term thinking—it's rapid learning (and actually taking action) compounded over decades.

The Real Enemy

The less you know about investing and the less educated you are, the more opportunity others have with money in the future. Less competition. More capital for them. They can do more because you didn't invest your money and match their capital.

The truth nobody wants to tell you: Investing is the only way you can catch up to the wealthy. But more importantly, it's the only way you can leave a legacy for your future kids, family, and future generations.

The Bottom Line

The “BUILD” framework itself is the skill worth learning. Understanding one company, one strategy, one market sector - those are all surface level steps. The real skill is -knowing how to break down any investment approach, uncover what matters, install the right sequence, and lock in accountability around actually doing it.

Your issue is not your capacity to understand investing, but instead it's your approach to learning it.

Most people are trying to become overnight billionaires when they should be finding the 20% that matters for their goals, putting it in the right order, and creating systems that ensure they actually invest consistently.

Master the BUILD framework once. Apply it to building wealth.

That's how you go from paralyzed by information to systematically building financial security.

Because here's what will be true in 2030:

The person who starts BUILD in 2026 and the person who waits will be miles apart. Not a little different. Not slightly ahead. Miles.

Your future self will either thank you or hate you.

The choice is yours.

Start today. Start now.

Because tomorrow isn't promised.

Luv,

Luv