What I wish someone had told me.

5 Biggest Mistakes of 2025 and how I plan to improve in 2026.

2025 was a great year for me. But it also taught me some hard lessons.

I'm not perfect. You're not perfect. No one is. The most important thing I can share with you isn't a highlight reel - it's how I learn from my mistakes and how I plan to pivot.

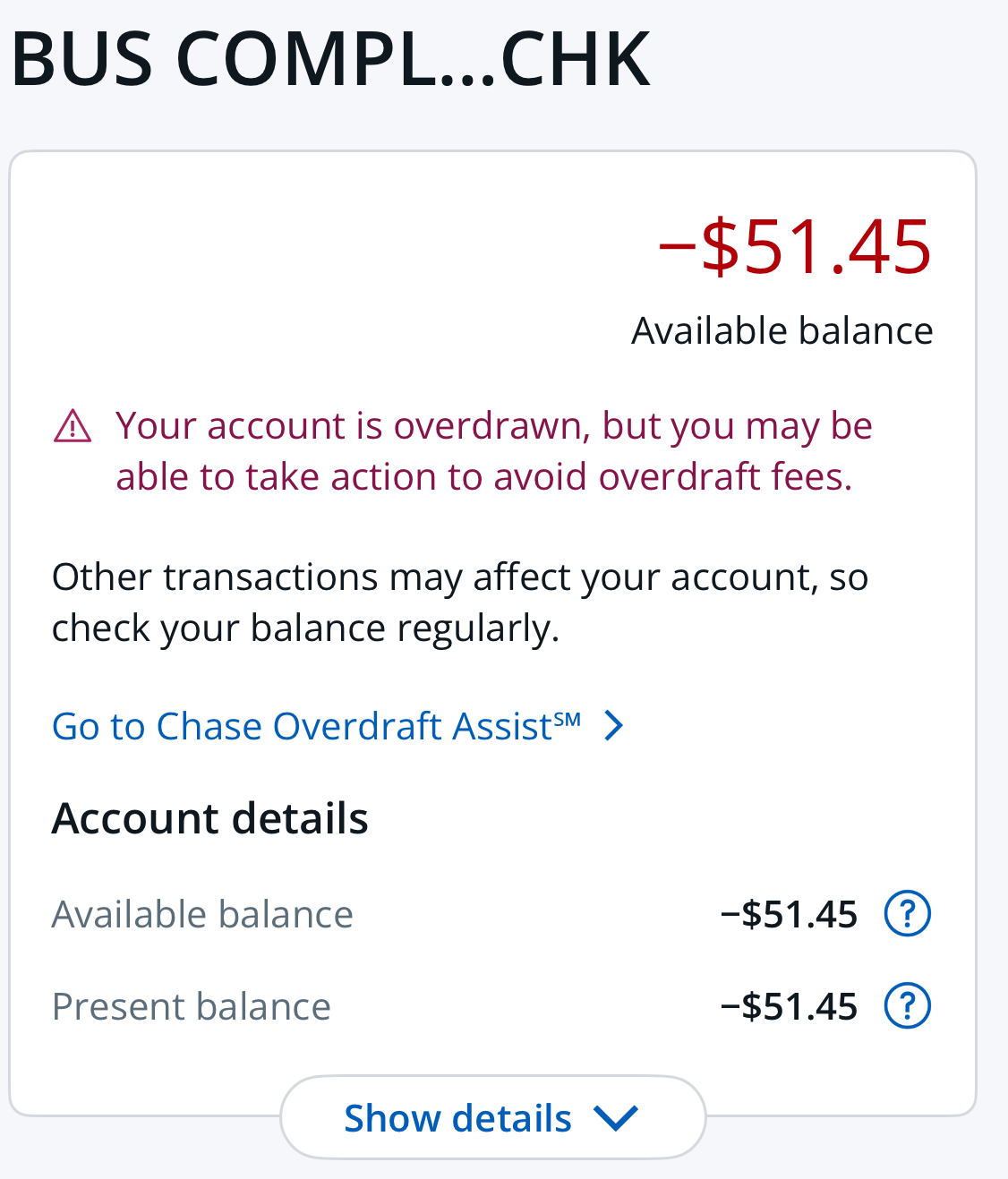

multiple times during the year, my business bank account went in the negative.

Every decision I make is centered around one thing: building wealth. And this year, I made moves that worked against that goal (don’t get it confused though - despite these mistakes, I am still in a better position than last year.)

Here are the 5 mistakes I made, what I learned from each one, and exactly how I'm fixing them in 2026.

PART 1: MONEY MISTAKES

Mistake #1: I got into stupid debt.

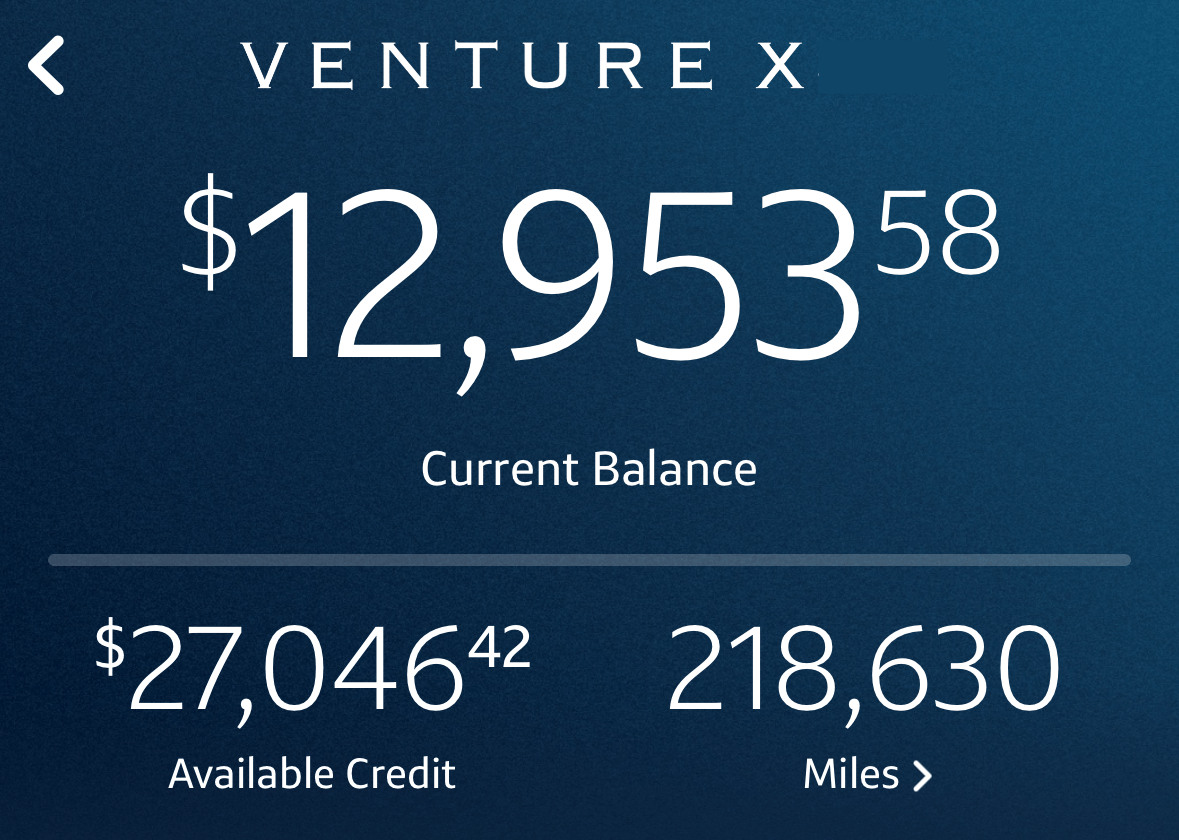

mannnnnnn my credit balance never been this high before. for me this is a lot of debt.

I am usually diligent with my money. I graduated with little to no debt. I've always paid off my credit card balance in full. But this year, I slipped.

Here's what happened: I made a big bet on myself. I paid a freelancer to build a budgeting app for me - an investment in future income. But the product fell through. And with that cash gone, I started relying on my credit card for everyday purchases instead of my debit card (needed to use cash/money for the app).

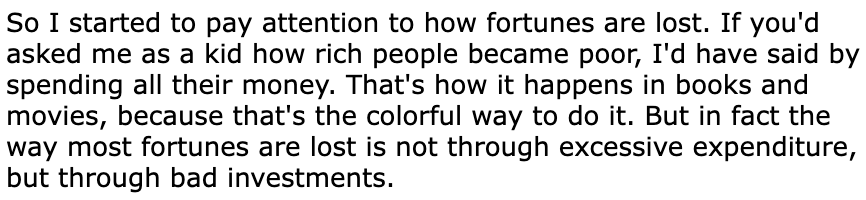

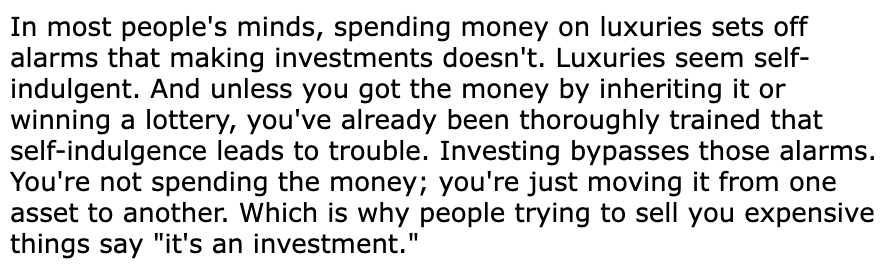

The text below is from How to Lose Time and Money by Paul Graham - explaining why this happened to me.

So now I'm in a debt hole. And it's scary.

What's even scarier? The opportunities I missed. Investment opportunities. Business opportunities. Savings I could've had for when I eventually move out. All of it - gone to a bet that didn't pay off.

The more money you make, the more you need to maintain the same discipline you had when you were broke. I forgot that.

The 2026 Fix:

okay okay - I might not cut them up. but best believe I will store them far far away.

I'm done chasing credit card points.

Done chasing miles.

Done chasing a higher credit score.

Here's my plan:

Using money earned from content creation to pay speed up debt payoff. I have more than enough brand deals lined up to wipe this clean.

I'm adding one subscription to each credit card, setting them to autopay, and putting the cards away.

Relying on debit card and cash for daily purchases

A good benefit about credit cards is you always have buyer's protection from scammers - so I might need to use another debit card and just reload money on it from my main bank account.

The only thing I want to chase in 2026 is positive cash flow. Build assets. Fuck the debt.

Mistake #2: I didn't save enough money.

Since graduation, I've been living at home with one goal: invest aggressively and build a rock-solid financial foundation. And my investments are healthy - I've poured every extra dollar into the market.

But here's the problem: I can't access those investments. If I want to move out, go on a big trip, or jump on an investment opportunity - I don't have liquid cash available.

as you can see here, I really do not save money…lol. the bottom account is one of my investment accounts I have been contributing to.

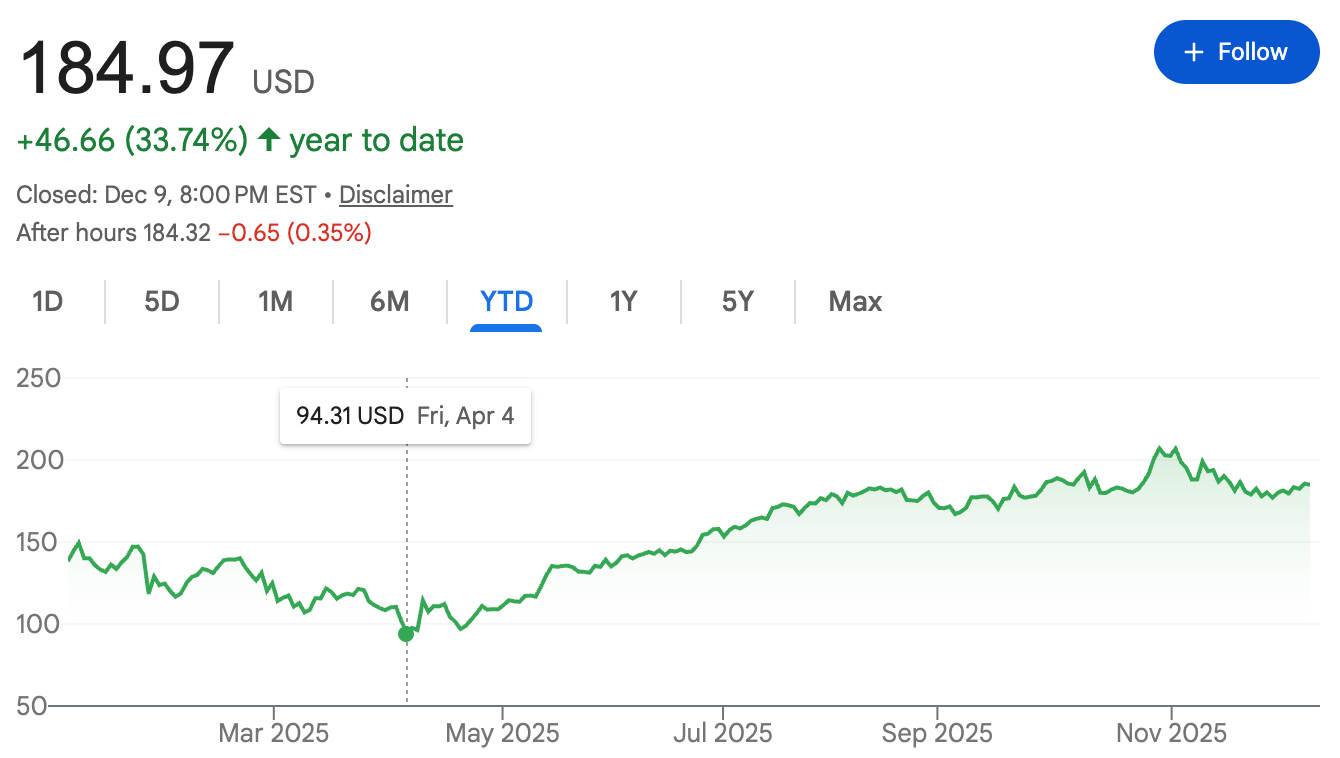

Real example: Nvidia dropped hard earlier this year. I bought some, but I didn't have as much cash as I wanted. It doubled within a couple of months. If I had more saved, I could've invested more and captured bigger returns.

just imagine if I was sitting on a pile of cash in April.

Living at home is a blessing and a curse. My expenses are low, so my emergency fund doesn't need to be as high as someone paying rent. But that made me complacent. I convinced myself I didn't need to save - and now I wish I did different.

The 2026 Fix:

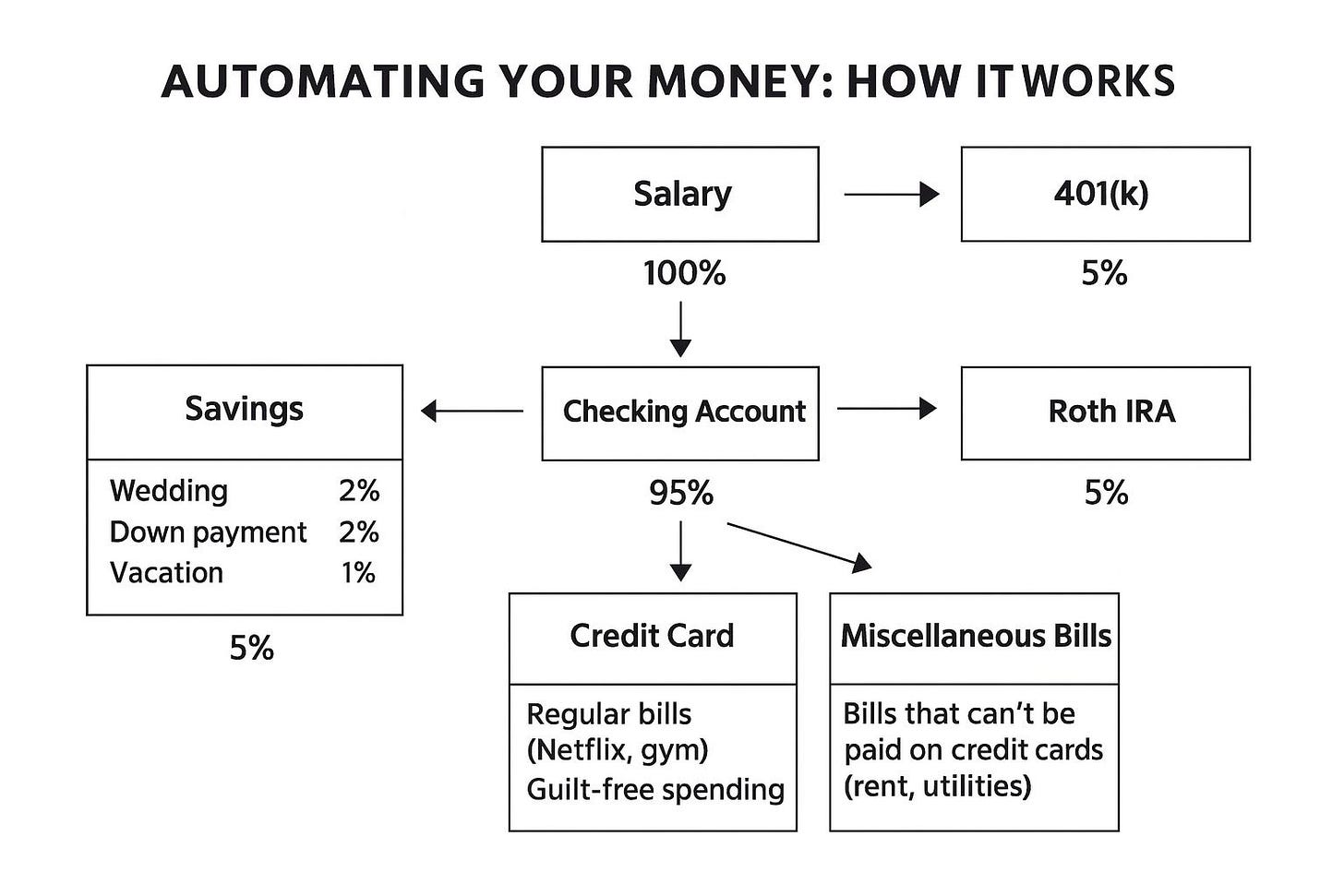

I already started. Every paycheck, $500 automatically goes to savings. I never automated savings before because I thought my emergency fund was "enough." It wasn't.

pretty simple example chart that shows how to automate your money when you setup your direct deposit.

If you are serious about automating your money here is a detailed breakdown from Ramit Sethi.

Once I payoff my existing debt, all of my creator income (after I set aside 33-40% for taxes) will go straight to savings. No new tech. No new equipment. Just great content and a growing savings account.

The goal is $45,000 saved - enough to cover a full year of rent, groceries, and fixed expenses if something were to go wrong.

PART 2: DIRECTION MISTAKES

Mistake #3: I gave up on YouTube.

I was on fire, and then I lost my spark.

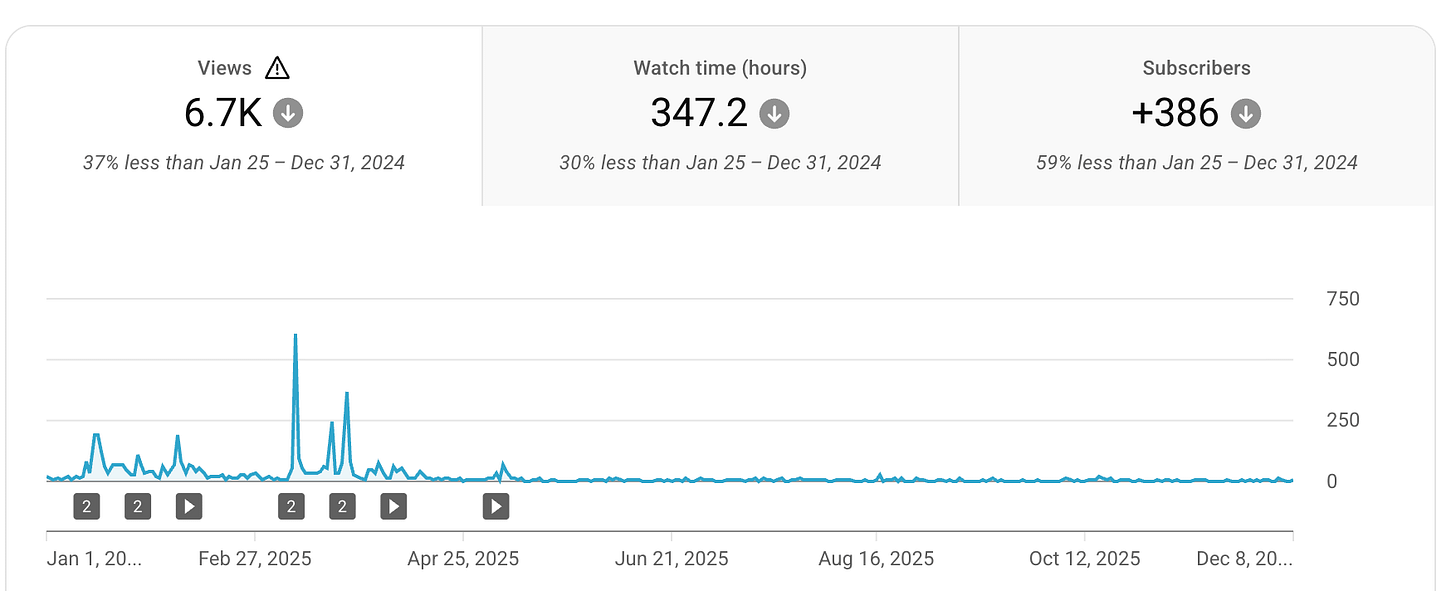

I ended 2024 with momentum on YouTube. Strong videos, strong engagement, consistent posts. That carried into early 2025. But over the course of the year, I dwindled.

Honestly? It was a lot. When I think about it, here were all the things I was trying to juggle:

Full-time job.

Short-form content.

Long-form content.

Weekly Newsletter.

Oh - also being in my 20s and wanting to enjoy life. I couldn't keep up.

When I stepped back, I realized something: I'm not a master of any single platform.

I'm knowledgeable. I'm good at what I do. But I don't have the numbers to prove it - no platform where I've crossed 100K followers.

And then here's what I keep thinking about: AI is going to flood the internet with short-form content. It's so easy to replicate. But YouTube is different. Long-form content builds a community. Die-hard fans who want to support you and watch you grow. I don't have that yet. And I need it.

My friend Angelo stayed on the path. We talked about blowing up on YouTube back in 2024. He kept going. I fell off. Now it's working for him.

show him some love, this is a content I actually approve of.

I'm proud of him. And more importantly his success is a reminder of what 1 year of consistency looks like. And I need to be consistent.

The 2026 Fix:

I'm getting back on YouTube.

The angle: documenting my journey of building a newsletter, growing a social media business, and everything in between. Weekly videos. Behind-the-scenes. Authentic.

I've been watching how Daniel Dalen does it - not his polished videos, but his raw POV and behind the scenes content. That's the energy I want to share.

And there's another reason this matters to me: representation. I'm young, I'm Black, I'm building a business. It's important for people who look like me to see someone doing this transparently.

Mistake #4: I didn't have a clear end goal.

I was making content for the sake of content. Earning money for the sake of earning money. I never stopped to ask: what's the point?

When I didn't feel like posting, I had nothing to anchor me. No bigger vision to pull me through. I'd fall into droughts - dark stretches where I didn't want to create anything.

Here's what nobody tells you about entrepreneurship: being your own boss is the worst.

There's no PTO.

No one else to rely on.

No one to hold you accountable but yourself.

You have to show up every day even when you don't feel like it.

Without a clear goal, you can't do that.

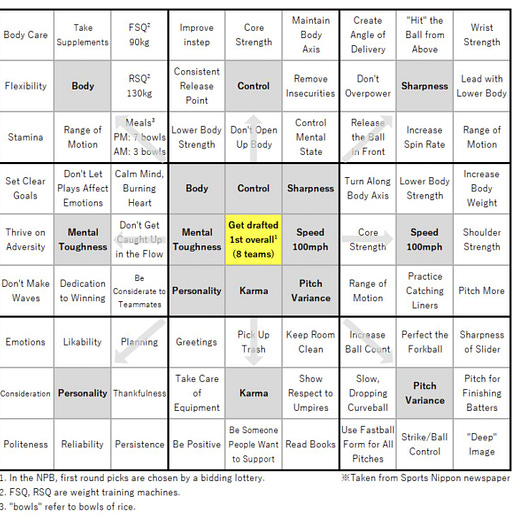

When it comes to creating a clear goal, I might copy Shohei Ohtani and replicate the Harada Method.

The 2026 Fix:

My goal for 2026: move out of my parents' house.

To do that, I need to reverse-engineer it. Let's say rent is $3,000/month. That's $36,000/year. Add a $10,000 buffer - I want $45,000 saved and ready before I make that move.

Ideally, I would replicate the Harada Method above and think of all the steps needed to move out of my parent’s house.

How much do I need to save each month? How many customers do I need for the budgeting app? How many brand deals do I need to close?

Whatever your goal is, work it backwards. Start with the end. Then figure out the steps.

PART 3: THE IDENTITY MISTAKE

Mistake #5: I relied too much on AI and social media.

Everyone says use AI - it's powerful, efficient, helps you move faster. And that's true. But I took it too far.

The first thing I do when I start working is open ChatGPT. Not a notebook. Not my notes app. Not my own thoughts. I go straight to the robot.

And my content started reflecting that. Formulaic. Rigid. Structured in a way that doesn't feel like me. I was creating faster, yes - but I was losing the spark.

❝

“He who optimizes for everything, enjoys nothing”

- someone said it, I think…lol

Here's the reality: as AI advances, everyone's content is going to start looking the same. Same hooks. Same structures. Same recycled ideas. The only way to stand out is to become a critical thinker. Someone who offers deep, intellectual takes - not hot takes, but real insight.

The same thing happened with social media. I was pulling all my ideas from Instagram and TikTok. Learning from others is good, but most of what's out there is surface-level. I was consuming breadth instead of depth.

I want to think more like a journalist. Look at different sources. Weigh different perspectives. Come to my own conclusions about money, content, and business - not just parrot what I see on my feed.

if you're interested in learning more about AI is making you too efficent, check out this article

The 2026 Fix:

I'm not quitting AI. But I'm using less of it.

Before I open ChatGPT or Claude, I'm going to gather my own thoughts first. Notebook. Notes app. Just me thinking. Then I can use AI to refine, expand, or challenge what I've already created.

I'm also cutting back on social media consumption and replacing it with deeper research. Books. Long-form articles. Multiple sources on the same topic. The goal is to build my own intellectual capacity - because that's the one thing nobody can take from me.

You can take my money. You can take my followers.

But you can't take my knowledge.

To actually achieve this goal, I'm going to get another phone that'll have all my social media apps on it for me to post stuff. Then, I'll leave that phone in a drawer until I'm ready to create content.

That's it. Five mistakes. Five lessons. Five fixes.

I'm not sharing this to look good - I'm sharing it because I know I'm not the only one who made these mistakes this year. And if even one of these resonates with you, I hope it helps you think about how you want to show up in 2026.

The goal hasn't changed, but the approach is sharper now.

PS - if you made it this far, thank you so much to all the people that went and checked out my new budgeting app. it means a lot to me. fr fr. 🫶🏾

Luv,

Luv